At least $300 million per year.

That is the ask the SEC should pose to CBS in its negotiations to extend the current Tier I rights deal for football games. Yes, it is a massive increase on the current deal valued at $55 million per year, but it is what the market suggests the SEC game of the week on CBS is worth today. Who knows what it will be worth in 2024 when the contract is actually up. Writing at the end of October 2018, Clay Travis speculated the SEC package was worth $250 million on the open market. On this singular point, Travis and I mostly agree. If anything, the value of the SEC rights is greater than his speculation.

Consider this: Under the current rights deal ($55 million) each of the 14 member institutions would receive $3.92 million before expenses. At $300 million annually, each school would receive $21.42 million before expenses. That represents a revenue increase of $17.5 million per school, or roughly the same as The Citadel brings in each year.

Ok, ok. I know that seems like crazy talk and that as an athletic administrator you are emailing the AthleticDirectorU team right now to say “what the heck are you printing?”, but hear me out on this. Admittedly, my methodologies are not sound science and would likely not pass peer-review, but I do more than merely speculate on a price by suggesting a mathematical formula by which the SEC can get to a $300 million ask. Additionally, it’s important to note there are contextual variables which could drive future college football ratings higher such as the lead-in and lead-out value of programming to individual respective networks, the branding power of partnering with the SEC, increased competition in the live sport programming space, and more.

Reach, or What is Old is New Again

NFL Media Chief and Business Officer Brian Rolapp underscored the importance of reach during a Bloomberg Business of Sports podcast last week saying, “We focus first and foremost on consumption. We have always been a sport that has been based on reach. We want to be on the platform that reaches as many people for as long as we can, and that traditionally has been broadcast television. Reach still matters, it is just more complicated in this day and age.”

Traditional terrestrial broadcast networks provide reach which pay channels, dependent on carriage deals, cannot. Having programming on ABC, CBS, Fox, and NBC is critical for reach.

That desire for reach may help drive the return of NFL programming to ABC. Andrew Marchand of the New York Post reported earlier this month that Disney is kicking around the idea of challenging CBS or Fox for one of the regular Sunday afternoon broadcast packages. A key driver in that would be the biggest “reach” prize: a Super Bowl every few years. If Roger Goodell is reading this, please mandate ABC talent wear the yellow blazers again as condition of this agreement.

It would seem we are seeing a slight trend away from pay television models back toward a model in which what was once old is now new again. Cord-cutting and carriage issues which have disrupted the sport industry are well documented. However, the importance of live sports programming cannot be understated. Even Hulu CEO Randy Freer, one of those disrupting the marketplace with 25 million subscribers, acknowledged the importance of live sports to CNN’s Brian Stelter in a podcast recorded at the recent CES show in Las Vegas. “The live is driven by news and sports. That is the bulk of the live viewing.”

In that conversation, Freer disclosed that only 50 percent of its traffic is live, with the other 50 percent being its on-demand service. He comments that the live piece is the most difficult to get correct, recalling last year’s Super Bowl in which they had a disruption of service.

Keeping the SEC on CBS at whatever price affords CBS the opportunity to maintain reach in sports, and hedge its bet should ABC shoot the moon on its NFL rights offering, and allows SEC to guarantee its product is seen by the largest possible number of viewers on a weekly basis.

Gambling

Take what you know about current college football ratings and teleport yourself into the future: colleges are receiving integrity fees and interest in sports gambling is at an all-time high. In November 2017, my colleague at the University of Georgia, Dr. Steven Salaga, shared insights from his paper in Sport Management Review on the link between betting market and television viewership in college football for Athletic Director U.

Salaga concluded his study provided, “empirical support that conferences and athletic departments are benefitting from consumer availability to gamble on college football. While conferences and athletic departments do not directly collect revenues from this market, they instead indirectly receive them from the sale of broadcasting rights – a product that sees its value elevated due to the demand for sports wagering and the subsequent consumer interest in viewing the outcomes of these wagers in real time.”

Future media rights deals in college football, and across all sports, should account for this growing market.

Ratings and Valuation

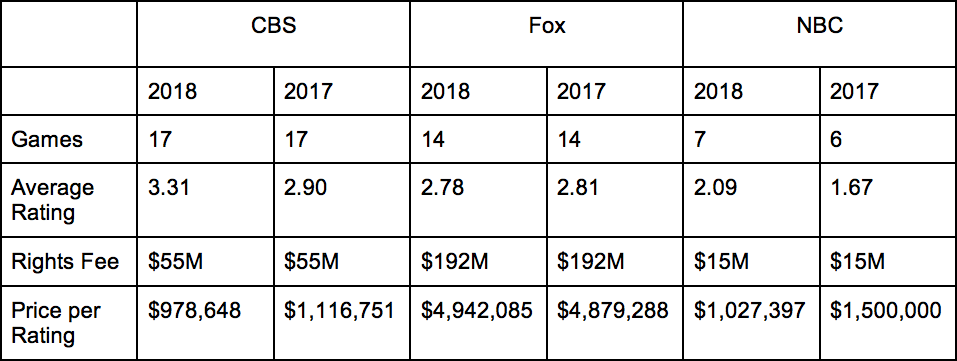

Using ratings data collected from SportsMediaWatch.com, I compared the three rights deals which provide an exclusive broadcast window on a traditional over-the-air terrestrial network. By eliminating ESPN, SECN, BTN, Pac-12N, FS1, etc. from the comparison we are able to get a closer representation of apples-to-apples.

2017 was the first year of the Big Ten’s new deal with Fox which places a Big Ten football game of the week on Fox. The deal was worth $240 million per year, according to John Ourand of Sports Business Journal, and covers both football and basketball. In 2017, Fox broadcast 14 Big Ten games, including the Big Ten Championship between Ohio State and Wisconsin. The network averaged slightly more than a 2.8 rating across those 14 games.

Assuming 80% of the $240 million value of Fox’s contract with the Big Ten was for football, that equates to Fox spending $192 million per year on those 14 football games. The gross ratings points Fox garnered in 2017 according to figures on SportsMediaWatch was 39.35, or around $4.88 million per rating point (one rating point in 2017 equaled 119.6 million households according to Nielsen).

By comparison, NBC paid Notre Dame $15 million for the rights to broadcast six Irish football games in 2017 (I am not including the Week 5 match with Miami (Ohio) which aired on NBCSN). Those six games averaged a 1.67 rating with gross ratings of 10. That translates into $1.5 million per rating point.

So, what of CBS? It spent $55 million on 17 SEC games in 2017, including the SEC Championship. CBS tallied gross ratings of 49.25, or an average of 2.9 across the 17 games (this even accounts for a zero rating from the Missouri-Arkansas game on the Friday after Thanksgiving). CBS spent only $1.1 million per rating point. As Richard Deitsch noted in this week’s Athletic column, SEC on CBS ratings were up 13 percent in 2018 (while Big Ten ratings on Fox were down slightly), lowering the price per rating point to under $1 million at $978.6 thousand.

The chart below provides a comparison of the last two years of ratings on CBS, Fox, and NBC. Again, ratings data was pulled from SportsMediaWatch.com.

So, how did I get to $275 million for the SEC? Here is my math…

If we assume the current market rate for Tier I college football rights is around $4.9 million per ratings point (what Fox is paying for the past two seasons of Big Ten rights), and we assume the SEC will average a 3.1 rating (what CBS pulled on average the past two seasons) over 17 games, then…

$4.9 million per rating point x 3.1 rating per game x 17 games = $258,230,000

Since 2017 SEC ratings were the lowest in the last five years, if we base our math on 2018 ratings alone, the price rises to $275,723,000.

As CBS Sports chairman Sean McManus told Deitsch this week about the SEC, “It is a Saturday afternoon staple for CBS Sports and it delivers great audience for us. Listen, we have a great relationship with the SEC and it would be our hope that sometime between now and the expiration of contract they would re-do the deal. It is a very important part of our portfolio.”

Given that importance to CBS, and the ability of the SEC to deliver consistent viewership, could the SEC also charge a 10% premium and increase its ask to $300 million per year? And, in the grand competition of college athletics, to think the SEC would only demand a 10% increase for what’s on par with the Big Ten is, well, unlikely. So, $300M annually. At least.