As college campuses across the country work to find new and creative ways to fund their athletics programs, at the core of their revenue generation will be the Multimedia Rights (MMR) agreements they sign with third-party sellers like Learfield IMG College. At last count, more than $500 million a year – more than $7 million yearly for Power 5 conference teams – was allocated to Division I athletic departments across the nation in return for the (mostly) exclusive right to sell the various marketing and sponsorship asset inventory each program creates.

With the near-term future of sports in question because of the on-going COVID-19 crisis, AthleticDirectorU and Navigate Research teamed up to explore just how Multimedia Rights valuations are calculated, so as to create a better understanding of how such deals may be affected with the shortening, or even elimination, of certain athletic competitions over the next year.

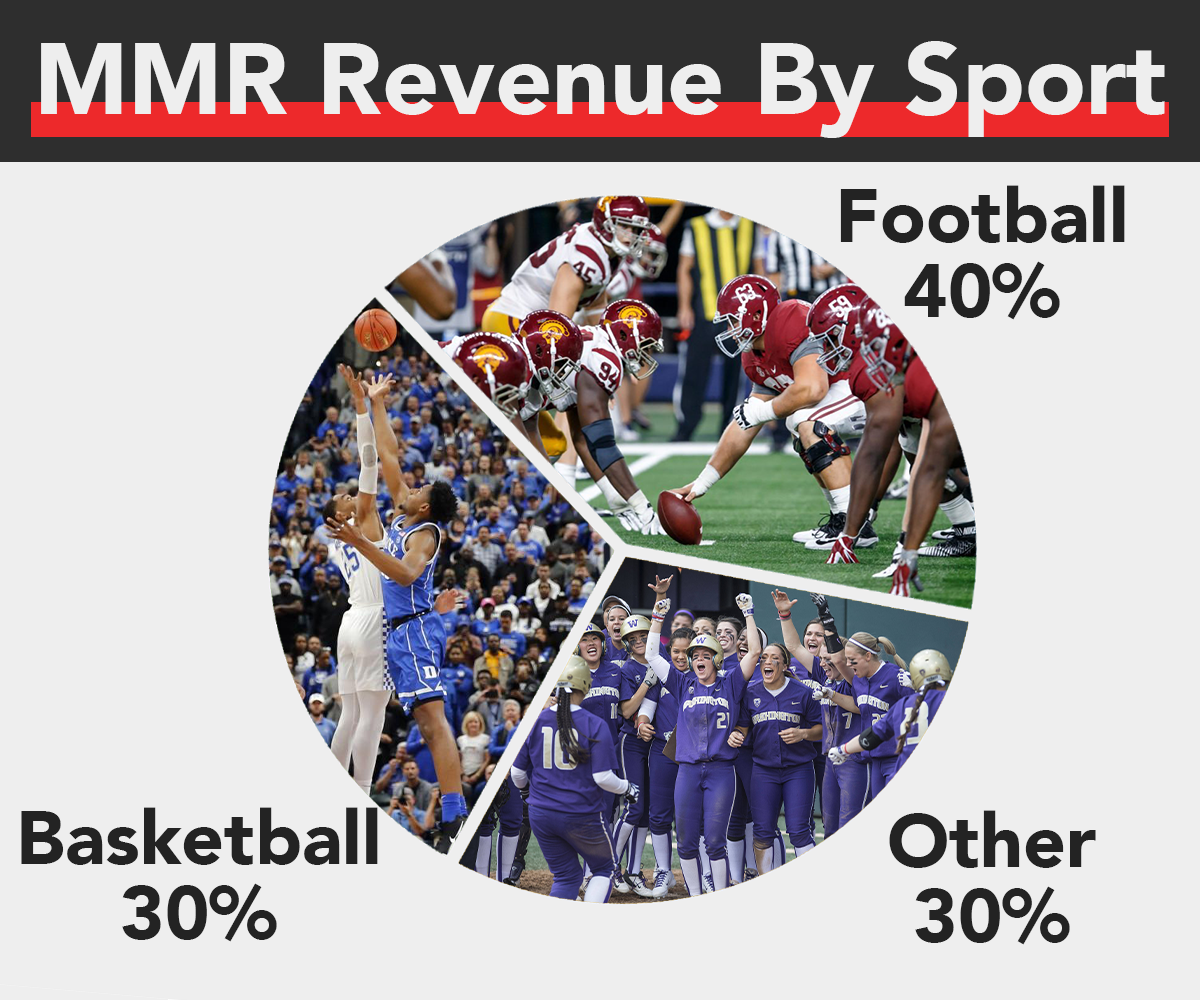

MMR Revenue by Sport

Based on Navigates recent valuation work with a number of Power 5 schools, approximately 40% of the value of multimedia rights deals comes directly from football-related exposure (in stadiums, during broadcasts, etc.) with another 30% coming directly from men’s and women’s basketball events. The remaining 30% comes from all sports collectively (athletic department websites, OOH available for sponsors and others), although an argument can be made that this remaining one-third is largely coming from football fans, just not directly attributable.

Most athletic directors and MMR sellers agree that as a benchmark, football accounts for 70-85% of total athletic department revenue. The same range is true for the influence of football on TV media rights deals. Regarding sponsorships, few partners invest in the Olympic sports a-la-cart or would invest at all if it was not part of an overall athletics package deal.

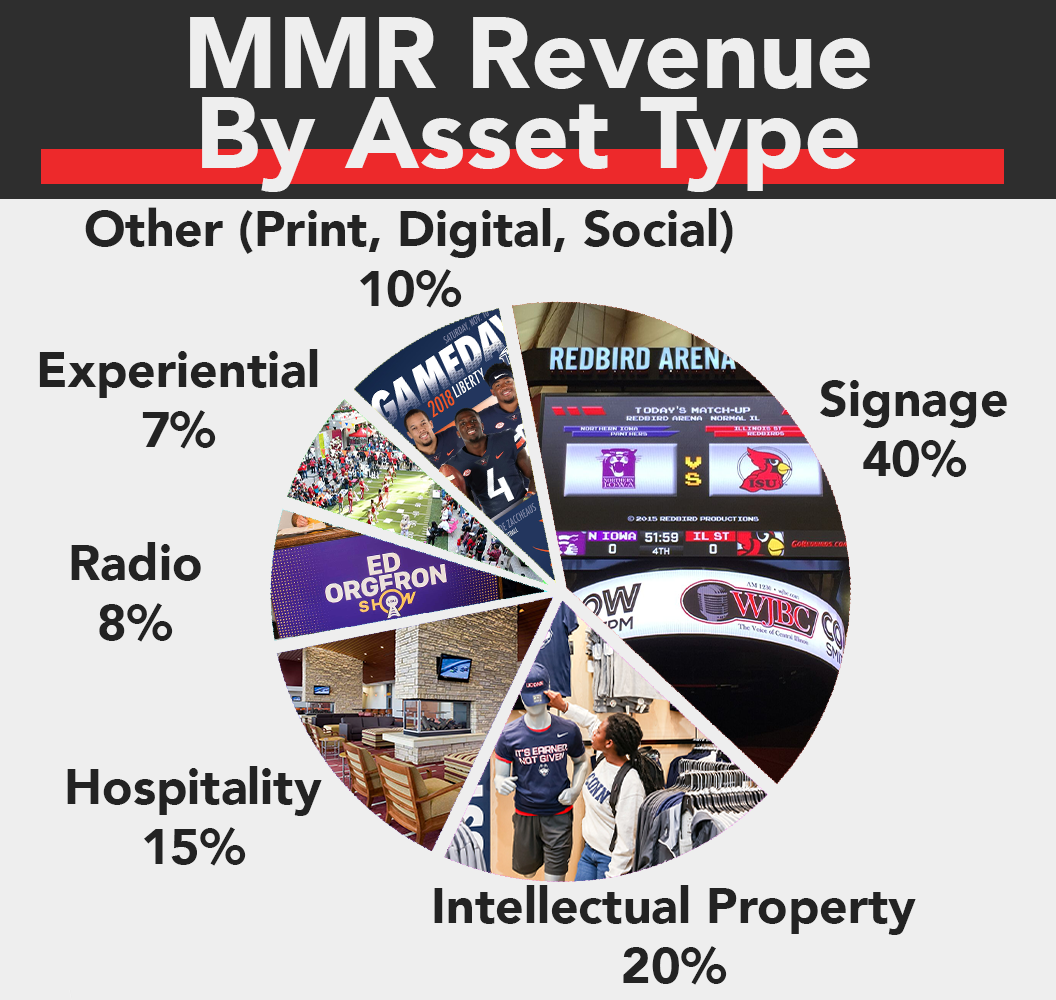

MMR Revenue by Asset Type

Examining the same collection of MMR valuation assignments, 40% of sponsorship exposure across Power 5 portfolios comes from in-venue signage that is seen in person and on TV, while Intellectual Property (marks and logos) provides another 20% of value, hospitality another 15% and various other media elements account for the remaining 25% of exposure. If collegiate events are played without fans, approximately 40% of sponsorship of value could be maintained through the effective use of IP, radio, digital and social assets.

MMR Contract Values by Expiring Year

Looking at the same MMR portfolios shows around one-third of revenue expiring this year with another third expiring next year and the remaining third expiring in two years or beyond. If COVID-19 ends up impacting the collegiate landscape for just a single season, it should help MMR sellers and athletic departments that the portfolios contain several multi-year deals allowing for makegoods in future years and potentially adding years to the ends of deals as a way to continue partnerships.

Guarantees and Revenue Sharing

Below are two examples of different types of financial models that MMR partners have in place with most university clients, with the riskiest for MMR partners being guarantees and the least risky being shared cost models. Overall, rights holders typically share 50-70% of revenue back with the schools, depending on the financial structure in place and the amount of revenue needed to secure any profits.

Guarantee Model – In this model, the MMR partner secures a deal in Year 1 where the revenue achieved by the school on its own (or with a previous MMR partner) is guaranteed upfront to the school, but that revenue grows at a rate slower than what the MMR partner can generate on their own, so they are able to keep the remaining revenue and achieve profits in the later years of multi-year partnerships. These deals also have revenue sharing shelves at different revenue levels so the schools can benefit from extraordinary growth.

Revenue Sharing Model – In this model, the MMR partner does not guarantee any revenue to the schools, but instead shares different revenue percentages at different revenue thresholds. For example, a partner might share 60% of the first $2M in revenue, 55% of the next $2M in revenue and then 50% of all revenue beyond $4M.

MMR Force Majeure Language

For the most part, Force Majeure language in MMR contracts is designed to let both sides come to terms with a newly structured agreement if events aren’t taking place. This means they can mutually negotiate a change in payments from the MMR partner, change the revenue sharing percentages or anything else that may be more in-line with a fair split of revenues. However, if MMR partners and schools cannot mutually come to terms with new structures when this process is triggered, then many of these contracts allow for contract termination. So, on the one hand, schools that have long-term and favorable MMR contracts will likely work hard to continue the partnerships and avoid termination. On the other hand, if there are schools or MMR partners that are in less favorable partnerships, they may use this contract language to terminate those deals.

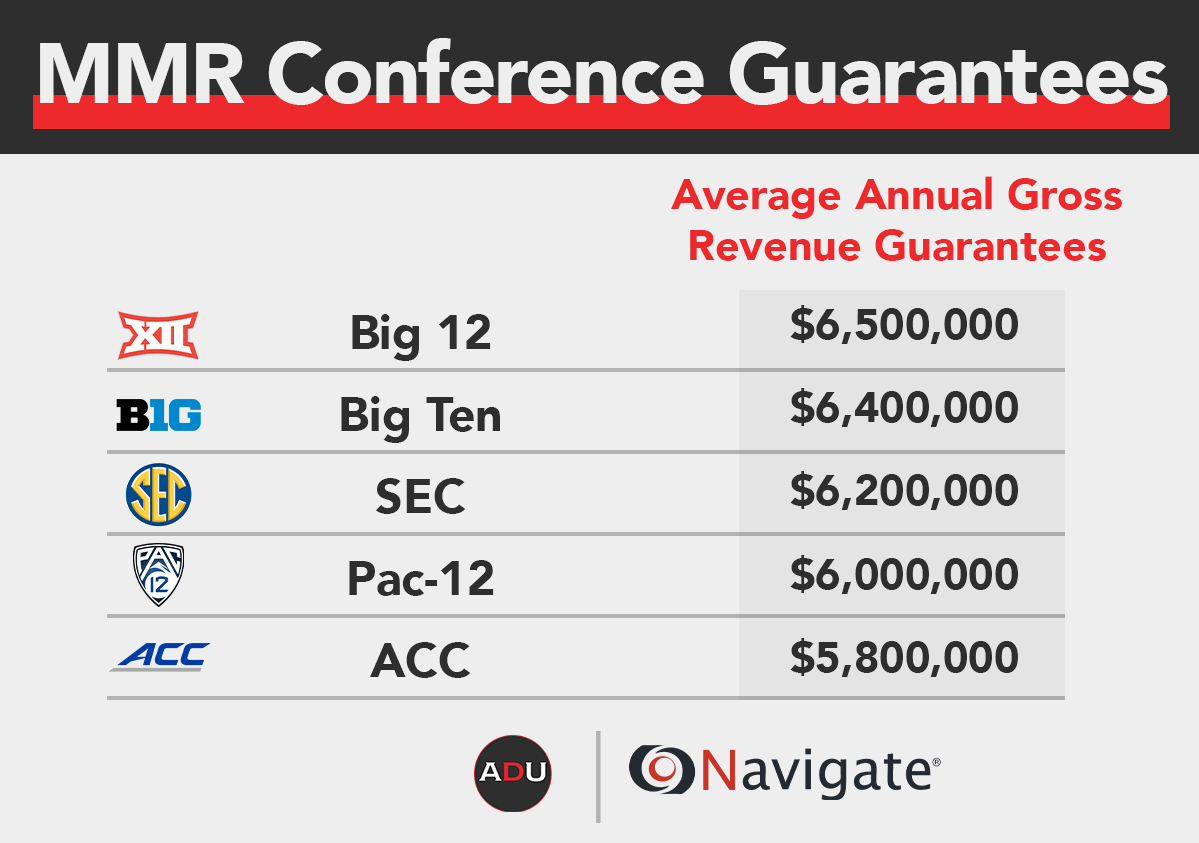

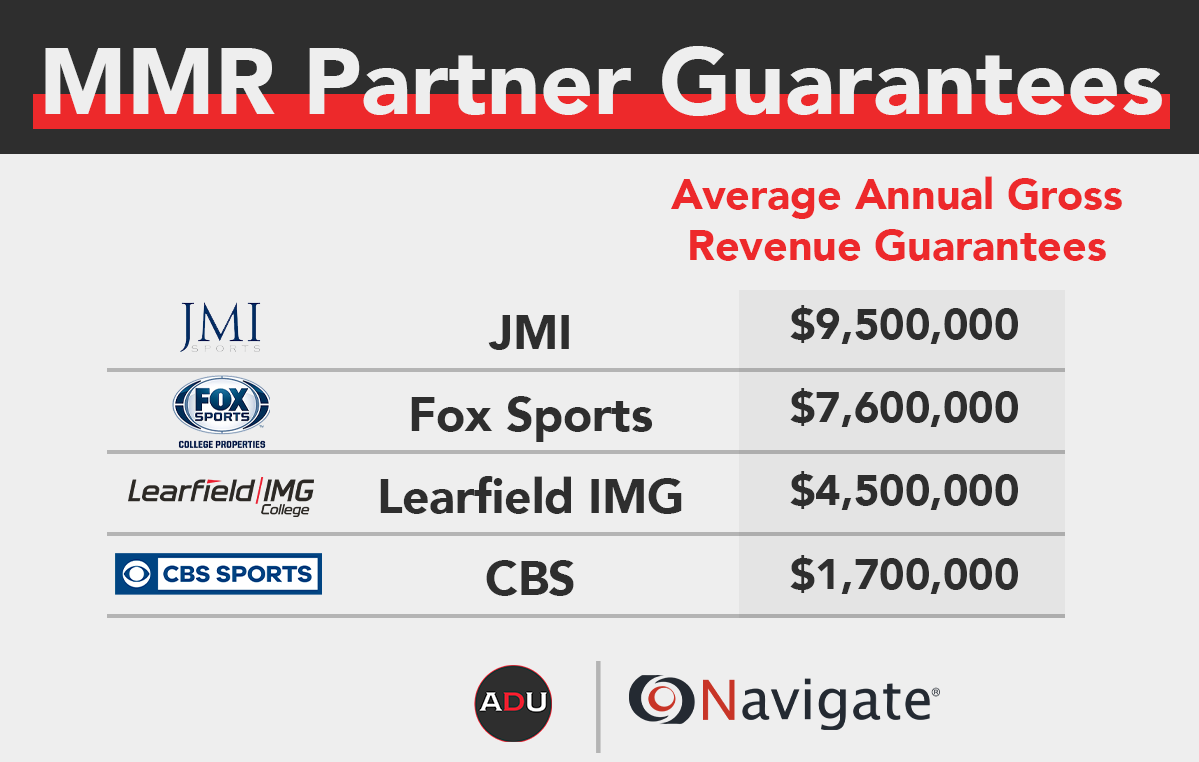

MMR Guarantee Comparisons

Based on previous research published on AthleticDirectorU, below are the results of combined data by conference and MMR partners. As a caveat, these are not the gross revenue numbers achieved by MMR partners, but rather the guarantees shared back to the schools, so revenue sharing is not included in these numbers.

The Future of MultiMedia Rights Deals

While MMR partners are responsible for a step forward in collegiate sponsorships when it comes to revenue performance, staffing, and service levels, they have also prospered through the creation of an industry segment worth billions. Universities (before outsourcing) would often grossly under-staff and service sponsors, hence the revenue levels that were less than half the inflation adjusted numbers of today.

Going forward, Navigate anticipates more MMR partners asking for revenue sharing relationships vs. a guarantee with revenue share shelves above certain thresholds. On the positive end, this aligns incentives for the athletic department (and university at large) to be a good business partner. On the flip side, without revenue certainty we anticipate athletic departments asking themselves, “why can’t we do this ourselves?”.

The profits to MMR firms and value created over the years could stay on campus if their performance could be replicated. A revenue share model is also a pretty low risk relationship for the MMR partner. Normally, a key motivation for athletic departments is transfer of that risk to a third party.

Currently, the vast majority of major universities outsource sponsorship sales compared to only a handful of pro sports teams. This is explained by the ability for MMR partners to hire and fire fast, compensate at market rate for salespeople, and share in overhead costs from radio production to national sales. But is it worth it? It is a question we at Navigate have explored for several clients the last few years and the tipping point and movement back to campus may be this moment in time.