With the College Football Playoff’s board of managers recently approving a feasibility study to determine the viability of an 12-team playoff model, and another possible round of major-conference realignment on the horizon, it seems all but inevitable the that CFP will expand within the next few years.

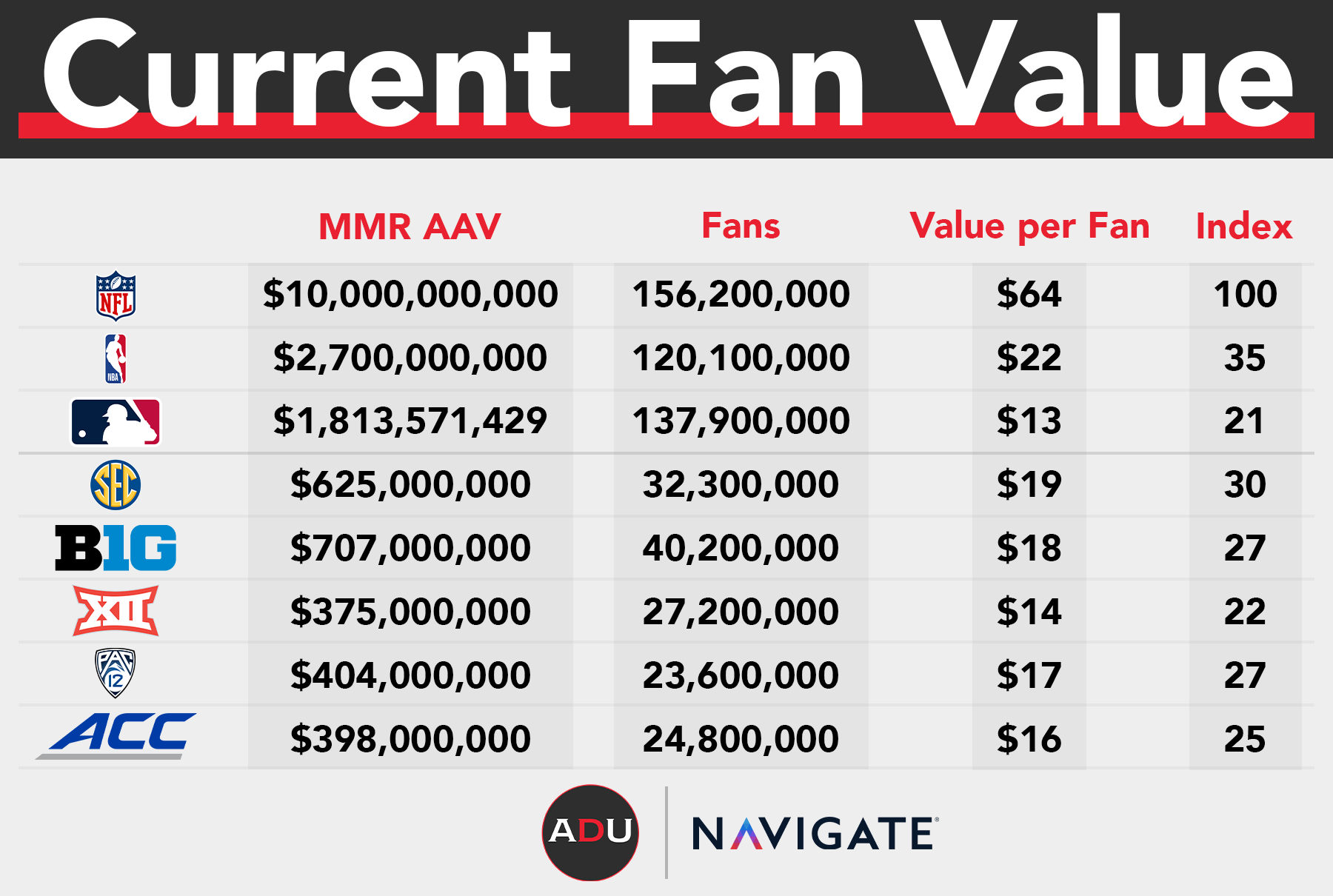

In order to calculate what types of revenue an expanded playoff might generate, we first had to determine what the value of an individual fan is relative to the current media rights landscape, and then how that value might increase with an expanded CFP Structure. The chart below shows our calculations for current fan value, in which all the different media deals are grouped together for each league to calculate a true “revenue-per-fan” number for each.

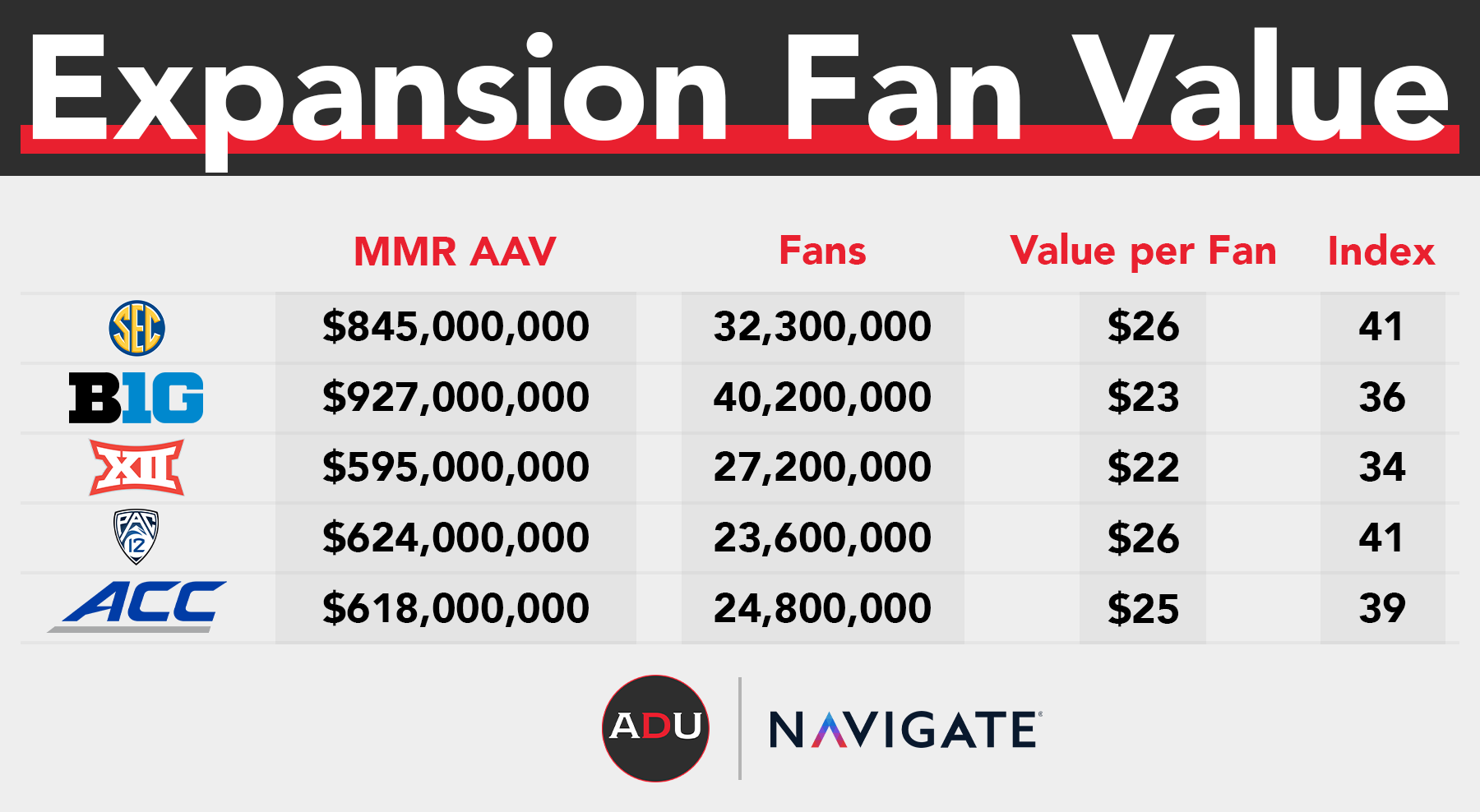

The chart above includes an index which allows us to compare the value per fan relative to the NFL for each league. The current CFP structure pays conferences around $103m per year, whereas an expanded 12-team playoff would pay closer to $323m per year, allowing us to create the below projections.

The current P5 average is only 26% of the way to NFL deals, while the new expansion would put college football closer to 38% of the way there. For perspective, 26% for now puts college football somewhere between NBA and MLB in terms of monetization, but the adjusted CFP would put college football above the NBA, which would be #2 among this comparison set.

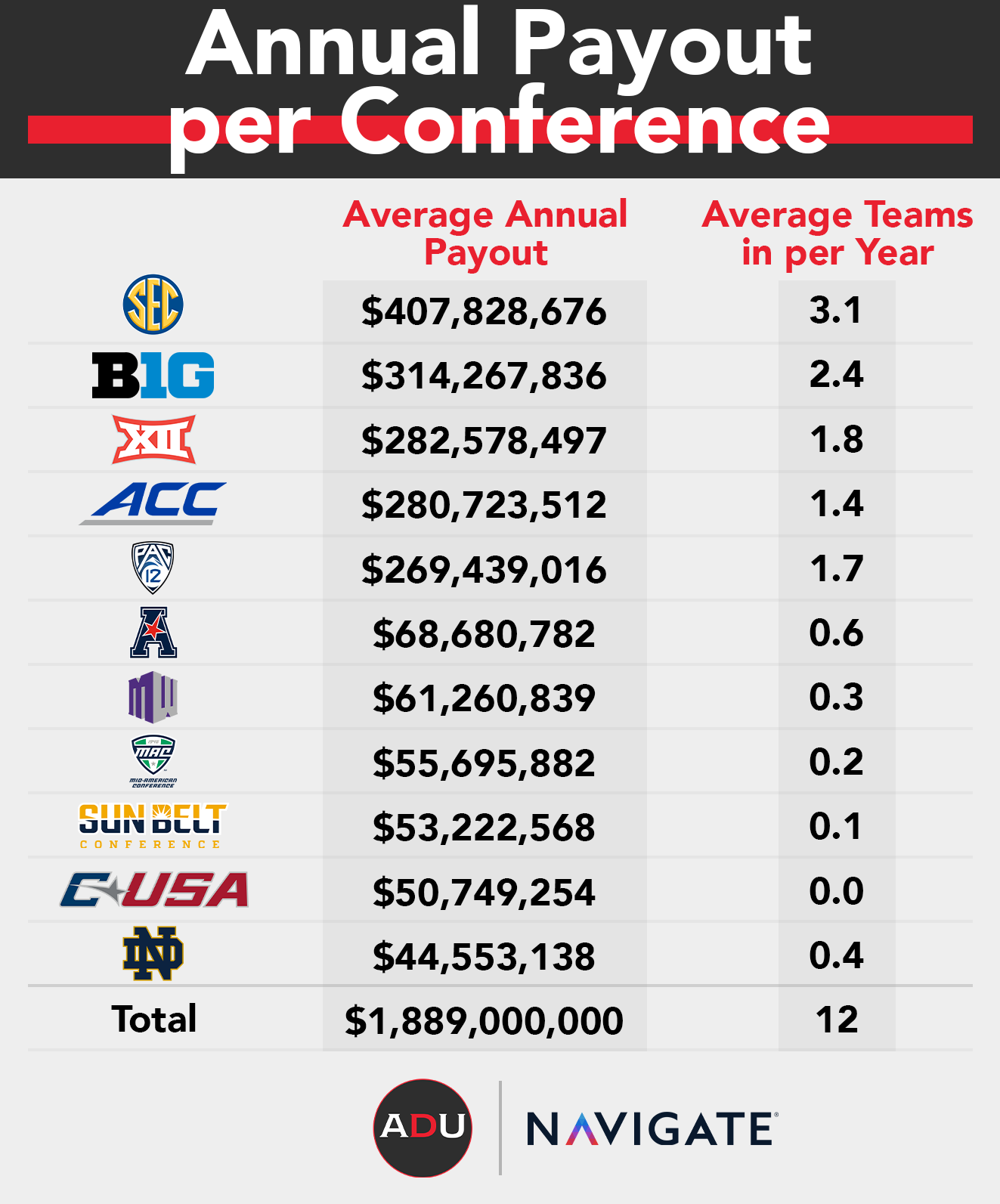

So how much money could a new 12-team CFP really generate on a per-conference basis? The below chart is our forecast and assumes the following:

- The current CFP payout for NY6 bowl games – including the 3 CFP games – pays all conferences $670M per year

- The new CFP payout for 11 playoff games that also take over all NY6 game relationships in a 12-team playoff pays all conferences $1.9B per year

- In the current model, 63% of payout goes towards base payments to conferences and the remaining 37% goes towards conferences in NY6 bowls and playoff games, which was also assumed in this new model

- To allocate non-base payouts, we looked back at the last 10-years of college football performance and assumed the new proposed 12-team playoff rules are used for participation to estimate the number of teams included in the playoff each year

- To estimate the value of each round participating, we assumed each round of the playoff sees increased TV viewership by 25%, and assigned values to each game, and totaled those estimates by conference and averaged them over the same 10-year timeframe

Our results show that had the 12-team model existed from the onset of the CFP, the SEC would have averaged 3+ teams and over $400M in payouts per year with Big Ten next at 2+ teams and $300M+ each year, followed by Big 12, ACC and then Pac-12 in terms of payouts. It’s also very interesting to note that Notre Dame ends up in a very favorable position if this scenario plays out as they would have been included in the 12-team playoff about 30% of the time and keeping full game payouts as opposed to splitting between other conference members.

Of course, the big caveat here is that we don’t really know how funds would be distributed in this scenario, but if the rules are similar as they are today with some adjustments to NY6 payouts being linked with specific rounds of the playoffs instead of with conferences, this could be the result.

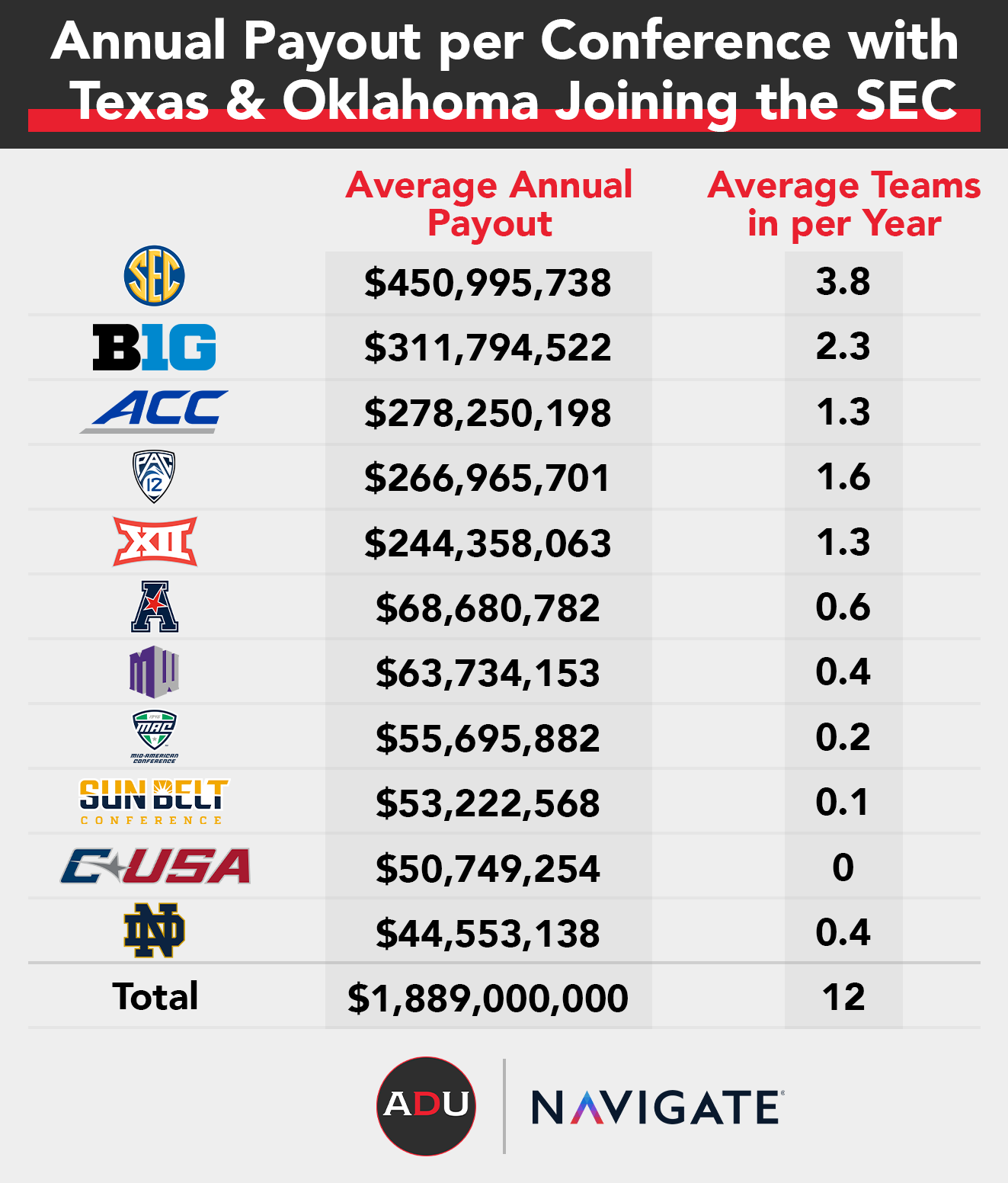

With news of Texas and Oklahoma possibly headed to the SEC, how would the this change the per-conference payout picture? As the chart below shows, the average payout per team for an SEC conference with 16 members is $28M, which is also the payout per member for the Big 12 before losing Texas and Oklahoma. So, the CFP payouts would essentially be the same under each scenario for UT and OU, but they’d face a much harder path to the expanded playoff by switching conferences.

AthleticDirectorU caught up with Navigate Senior Vice President for Analytics and Innovation Matt Balvanz to discuss further. You can listen to the conversation below and read the full transcript below.

Full Transcript

Tai M. Brown: Greetings. This is Tai Brown and welcome to the AthleticDirectorU podcast. I am joined by Matt Roberts, also from AthleticDirectorU. And our guest today is Matt Balvanz. Matt is the Senior Vice President for Analytics and Innovation at Navigate. Greetings, Matt, thanks for joining us.

Matt Balvanz: Good morning. Happy to be here.

Tai Brown: Now, with two Matts on, I may say Matt Roberts. I may say the whole name so I can coordinate both of you guys, Matt. Matt, if you’ll say hello to everyone, so people know your voice, Matt Roberts.

Matt Roberts: Morning, guys. Hello, everyone.

Matt Balvanz: Yeah, hello, hello.

Tai Brown: All right, Matt Balvanz, you’ve been at Navigate for 14 years. Of course, Navigate is a consulting firm in sports and entertainment focused on data and analytics. And you guys recently put out, I guess, there was some analysis looking at the impact that potential College Football Playoff expansion could have on the potential revenue to conferences for media rights, and also how the spots from the playoff may be allocated. Give us a little thought or insight on Navigate’s thought process, your thought process in coming up with this analysis, I guess, is what we’ll call it.

Matt Balvanz: Sure, yeah. So when these big stories come out about media rights and expansion and different ways to monetize these lucrative rights, we always kind of love to go back to the drawing board and do some analysis to see what’s really going on under the surface. And our gears are always turning for what some interesting storylines could be coming out of these things.

And so, two things we did, you kind of nailed it. One thing we looked at how the professional sports leagues, so NFL being number one, and then NBA, MLB and down the road, how well they’ve been able to secure their media rights deals relative to how big their fan bases are, and did the same for the college space, just to kind of see on a per fan basis who is making the most money today, and how this 12-team playoff positions college football if it were to go through and how big of a how big of a leap this truly is for them. So that’s one look at it that we did.

And then the second is then we said, “Okay, well, that’s, if all things are equal, across these Power Five conferences, but we know some of these conferences will slot in more teams than others into this 12-team playoff. So if history is our guide in estimating which conferences seek to gain the most from this expansion, we looked back 10 years to see kind of how this would have shaken out had this been in place 10 years ago. So some interesting findings to share for sure.

Tai Brown: Right, I’ll say this. This is interesting to me because the College Football Playoff and expansion makes things so complex. And then also when you talk about analysis and looking at numbers and data is not my first, the first thing that I think about, right, so I’m gonna come at it from an educate-me point of view. And of course, Matt Roberts would probably like to dive deep into things because that’s what Matt does is dive super deep into things.

And my first question for you is you guys came up with an estimate of money allocated to conferences of $1.9 billion, almost $2 billion. Walk us through a little bit of that process when you talk about that number.

Matt Balvanz: Sure. Yeah. So what we did is we looked at the current College Football Playoff payout structure, and so that’s money coming from ESPN to the CFP and then distributed from there. And really that payment today, which is I think in the 600 million to 700 million a year range, that’s really just covering a three-game playoff and the New Year’s Six games as well. But a big majority of that 600 million to 700 million is just from those three games. So what we did is we looked at how much they’re paying per TV viewer for that current deal. And we extrapolated that out to how many TV viewers we believe would come from a 12-team playoff, which you’re talking instead of three games, now you’re talking 11 games.

And also just the marketplace for media rights today versus when that original deal was done, I mean, you hear all of the NFL deals without changing much of the inventory have doubled. The NBA wants to kind of double their deals. You just heard the SEC kind of switch from CBS for their prime games to ESPN. And that deal, I think, more than tripled. And so, the marketplace today is just a lot riper.

So you know, you’ve tripled the inventory and put it into a new marketplace. That kind of triples, in our calculations, to put it simply, that kind of triples that 600 million to 700 million, up to close to 2 billion a year now.

Matt Roberts: And, Matt, comparatively, when we talk about the NFL being the king of the fan, in terms of just overall raw volume, and you noted the NBA wants to double. We know where Major League Baseball is headed, but give us some context of if the CFP contract goes to $1.9 billion, like you guys are projecting, how does that compare to the major pro leagues and their overall pie?

Matt Balvanz: Yeah, I mean, and this really reveals how great the NFL has done in monetizing their product. Because they’re in the $10 billion a year range now as a league with the new deals that they have secured. And so, if you treat that kind of as the gold star, it kind of comes out to around $64 per fan in the US, not just in the US. So, because that $64 per fan, now, jump to, say, the NBA, who they’re getting close to $3 billion a year as a league from their TV rights. But that only comes out to a little over $20 per fan. So the NFL is squeezing three times the revenue per fan. The NFL is three times the revenue per fan than the NBA. And so, think of what all the creative things that the NFL has done. I mean, right now they’re selling games two and three times where non-exclusive rights you’ll see a game on NFL Network while its broadcasts on Amazon and all kinds of things. And so digitally and linear TV and social and all the places we see the NFL brand at a premium, that’s the reality kind of 3x today from the next closest league, which is the NBA.

And you asked college football, more specifically, as we’re talking about today, before expansion, college football is around 25 percent of what the NFL is doing. So think of really around a little under $20 per fan in today’s deals. But if we were to expand it to 12, that moves up closer to about 40 percent of where the NFL is. So it moves them ahead of the NBA in terms of being next closest to the value per fan, but still room to grow to perfectly align with their strategy 40 percent of the way there by our calculation. So yeah, interesting stuff.

Matt Roberts: And it’s important to note for context for those who listen to this conversation, and who read the transcript. We’re chatting on Thursday, July the 22nd. And clearly the massive news that hit the wire, let’s see, probably around 4 o’clock yesterday, 3:30 Eastern yesterday was this potential for Oklahoma and Texas to head to the SEC, which is not considered in some of the research you guys did, but just adding context for everybody here who’s going to consume this on Sunday or beyond a couple days from now, that’s clearly an important marker in our industry’s development that could impact these numbers as well. And I’m sure you have some offhand thoughts, Matt, we’ll come back to those. But I know you guys haven’t dug into a lot of analysis of that potential move. But it is worth very much noting at this point in time.

Tai Brown: It is. You know, that’s very interesting. And we will circle back to that because I do want to get actually both of your thoughts on that. Notre Dame though, now, when I look at, I think the number for SEC was $407 million-ish, something around there, 14 teams divide that up. That’s roughly $30 some odd million each team. I guess, if somebody makes the playoff, Notre Dame though, right? It was that $44 million, which was significantly more than everybody else.

Matt Balvanz: Yeah.

Tai Brown: Should they make the playoff. Give us a little information about that.

Matt Balvanz: Yeah. That’s a great question. And so, I think, with the Notre Dame piece here, the reason… so the way that the CFP pays Notre Dame today is they get kind of a fixed base payout of just a few million dollars a year. And then if they proceed to the semifinals, or the championship, there are some other payouts that they would make for advancing.

But what they are benefiting from is that they’ve actually had some pretty good performance in the last 10-year window that we look at. I think every three years or so they would have gotten into a 12-team system and advanced a few rounds in. And so they would keep the money from them advancing to those rounds, and they would not have to share it with a conference, if they’re not in a conference. And if we’re treating these games equally, the way we’ve sort of hashed this out, so yeah, in Notre Dame’s case, in this analysis, where we’re trying to put together a system that shares equally among participants within a 12-team system, they do have the benefit here.

But again, I think most of it is driven by how often they would have been represented within this system over the last 10 years. But the base payout wouldn’t be anywhere near… they wouldn’t have guaranteed payouts anywhere near what these conferences would be getting and then splitting. So it’s kind of a two-sided story. But yeah, there’s definitely some high upside for Notre Dame if this came true.

Matt Roberts: Yeah. And the Notre Dame piece of the narrative here and in college athletics at the Power Five level and beyond is always present. But can you back up one step for us, Matt, and we alluded to this potential increase in the new CFP media package being worth $1.9 billion. But how did you guys… let’s just, let’s educate Tai and I and the audience on how you guys arrived at this average teams per year in the playoff metric, which would be then connected to the average annual payout?

Matt Balvanz: Right. Yeah. So what we looked at is we thought that the best way to sort of spread this money was based on TV viewership. So earlier rounds would get probably fewer TV viewers. And so, a lower payout for teams participating in the earlier rounds versus working your way to the championship game, which, in theory, and hopefully would have the largest TV viewership.

So we looked back at history again, and we saw pretty consistently that the semifinal rounds of the CFP had about a 25 percent fewer TV viewers than the championship game. And so we just continued that trend of the 25 percent decline from round to round. And so, if, again, we kind of like to say it, if history is our guide here, that 25 percent decline as you work your way outward, is kind of how we allocated the value for each of these games.

So fewer viewers, fewer dollars, but as you advance, you get access to the more lucrative dollars and the more lucrative games and that’s kind of how money is distributed here.

Matt Roberts: And to be clear, you guys are not suggesting that this new package of games gets sold in any particular manner and in essence, not that it’s all with ESPN, or that it you know, like the NFL gets divvied out to all the major broadcast and cable players, right? That’s agnostic, correct?

Matt Balvanz: Yep. Yeah, exactly. And, you know, I think if this were to actually happen and I think today’s climate is, again, I mentioned before, but pretty ripe for deals like this. You have all these different streaming players trying to get inventory to drive people to their streaming platform. And that’s just from people who already have a linear network, right. So they’re balancing linear with their streaming. And then you have people that are streaming only, like your Amazons coming in and buying pretty significant package from the NFL recently. And Apple, I think, was just in the news saying that they intend to kind of go this route too. So you know, more competition drive these rights up. And maybe this is a chance for college football to divvy up between several different players and different term lengths and get creative to the way the NFL has lately. So yeah, there’s a lot of different strategies they could follow.

Tai Brown: You know, it’s interesting to me, and Matt Roberts, you probably can chime in on this, too. I think most of these games, I guess, in the playoff will be played on campus, right. And so, you’re thinking about revenue from a game played on campus using campus resources, personnel, etc., right? How does that factor in or impact the numbers that you guys have come with in terms of the distribution of conferences?

Matt Balvanz: Yeah, the campus game concept is interesting. I think what I heard and I may be wrong and evolving. But what I heard is that the first round is really the only round that would be played on campuses. And so you’d have four games in that first round on campuses. And then the remaining games would really have to be the New Year’s Six bowls that sort of exists today, and get distributed that way, it’s kind of a clean way to do, sort of that middle, those middle two rounds. And then the championship game obviously has its own branding and its own positioning. So that first round is campus games, but none of the top seeds would play in that first round. It would all be sort of the lower seeds trying to make it into the next round of the tournament.

So you’d have this situation where, “Okay, Alabama, congratulations, again, you’ve made it to the playoff. You’re probably a one or two or three seed, but you’re not going to have a campus game, realistically, because you’ll never be playing in that first round.” So does that make Alabama upset, potentially, I know, Nick Saban probably prefers to not have it on campus, because he likes his guys focused and thinking about the game and maybe getting them out of their home field helps them do that. But man, you got to think the schools and the administrators of these really high ranking teams historically would be salivating over a chance to have campus games. But I think from a financial standpoint, the TV money is just broadcasting the game, right? So the TV money I don’t think changes. I think, if anything, the pandemic kind of taught us that one factor of TV ratings may be declining is the atmosphere of what you’re watching on TV. So if you have a rowdy college atmosphere of a packed stadium, for the first time, sort of watching their team in a playoff, man, I think that could really draw some TV viewers to those campus games, maybe even higher than what we projected in our modeling. So I don’t think it has a negative effect really, maybe operationally it’s tougher on those schools to have a packed house at that time of year and there’s a lot of new things, maybe new camera angles and new infrastructure and things like that, but I don’t think it affects these TV dollars.

Matt Roberts: Yeah, that’s a really interesting and it makes me think of like a whole separate sub-study here of is there, historically, better TV ratings for hyper high-profile regular season games? And I’m thinking about the likes of Auburn and Alabama, Ohio State-Michigan, Georgia-Florida, Alabama-LSU, those types of games that are campus settings versus even potentially conference championship games that are played in Atlanta or Dallas or wherever else. This is more of a sidenote and a thought, but I was going to curiously ask your opinion on that. But that sounds like something else we might need to dig in on.

Matt Balvanz: Yeah, I mean, I think the short answer is that they’re fairly comparable. I think high profile versus that have maybe less playoffs meaning can have pretty close TV ratings to ones with high meaning and neutral sites. But I think this is where this is a little bit different is that, at least early on it kind of being the first on-campus game as part of a playoff kind of all coming together, maybe there’s a honeymoon effect in the first couple years where people are tuning in to see what a campus playoff game looks like, right? Just for that. But yeah, exciting times to think about.

Matt Roberts: Certainly, what’s most eye opening here in this research, as folks are going to see, the projection of every Power Five league generating in excess of $250 million per year, and you just do the math on the current makeup of the conferences and divide it equally among each member, and you’re talking about significant increases to individual campus-based budgets. So the overall dollars are just striking. But I’m curious of your opinion, Matt, like, in the TV environment, what could… it does feel like we’re in this optimal time of the TV world. And clearly, that’s the powers that be and the decision makers have analyzed this just from every angle, and I know this too, but like, what could go wrong in the next 24 to 36 months that somehow changes the paradigm of the value of this property in the marketplace?

Matt Balvanz: Yeah, good question. I mean, it’s always good to kind of think about what could derail all of this. And, I mean, I don’t see a lot that could. I mean, I think the pandemic has taught us that live TV is still where a lot of stakeholders in all industries still buy and make money off of and live sports is really keeping it all together, the advertising train. And so, if any brand wants to advertise, live TV is at least in for the foreseeable future, kind of A1, the spot to be. And all the different players kind of literally learning that lesson and getting involved.

And one interesting thing that I don’t see a lot of people talking about is companies like Amazon and Google and Apple who think of how much more they have to sell and make money off of by capturing these eyeballs, right? Amazon sells everything. I’d say 90 percent of what we buy is from Amazon at this house. And whereas ESPN, what are they selling to consumers really? They’re getting money from subscriptions, which is tricky in itself, and they’re getting money from advertising, and that’s it. But Amazon sells you anything.

Matt Roberts: And carriage, the standard carriage rates, of course.

Matt Balvanz: Yeah. But Amazon sells you everything. And Google sells you everything. And Apple sells you a bunch of stuff, too. So there’s… a customer is worth a lot more to those companies than to ESPN. And I don’t know how the modeling will shake out, the financials or the lifetime value of customers to those companies versus ESPN, but it’s an interesting thing to think about. But yeah, I mean, what could derail it? Let’s say ESPN and/or Fox or these big legacy partners kind of wave the white flag and say, “This cable, this concept is kind of breaking down, people are going digital.” You know, I know that for everybody that cuts the cord, ESPN is losing money for people that cut the cord, right, and then switch to their digital just the way it’s monetized today. So at some tipping point, maybe that happens very quickly, and things go south and something major happens with ESPN or Fox, these big legacy partners. But I just don’t see that. I just don’t see that either. I just think brands keep them afloat.

And one other sidebar, because I just can’t help it, I love to geek out on this stuff, is that the rate that these rights fees are increasing is actually slower than the rate that our bills are going up for access to watch them. So, we’re a YouTube TV house here. But I think when we first started subscribing, it was like $40 a month, and now it’s up to $65 in just like a year and a half, and so there’s big… I’m paying more every year at a higher rate than these rights are selling for. And when you look at commercials, the rates that brands are paying for commercials on a per-person basis that’s rising faster than these rights feeds as well. So you’re selling $6 million Superbowl ads this year, but viewership is on the decline over the last few years. So brands are paying more to reach fewer people…

Matt Roberts: Right.

Matt Balvanz: …each year. It’s kind of crazy.

Matt Roberts: Yeah, that cost per 1,000 number keeps going up. And I do think one element of this ecosystem that we don’t talk enough about is the pure and simple fact that massive brands and massive ad trends when it comes to achieving scale, and TV is still such an optimal delivery vehicle for the scale of eyeballs, right? But I want to go back to one thing you said specific to Amazon in the context of a value of a lifetime customer and everything else it’s selling etc. Are you saying that in the context of potentially Amazon could be a primary bidder for a piece of these rights? Or are you going back to alluding to how the NFL has leveraged Amazon as a secondary broadcast partner to games that are being shown elsewhere as well?

Matt Balvanz: Yeah, I’m more so hypothesizing that there’s people in a room at Amazon kind of doing the math on these deals, and to see if having primary rights pays out to them. And I would think in those financial models, they’re talking about how they can get more customers buying things from their website. And the lifetime value of a new customer to Amazon has to be worth a heck of a lot more than the lifetime value of a new or current ESPN subscriber.

And so, guys smarter than me and smarter than us are running those numbers, I’m sure right now, but I just have to think, I just think someday they are going to, the math is gonna work out and they will be a major bidder and buy some rights. And I mean, just think about what they could do is they could have you streaming something on Prime, let’s just say it’s an NFL broadcast, and then they run an ad. And it’s an ad for their own products, and you just click the screen, and you just bought it, and it went through your system, and it shows up at your house, maybe by halftime from a robot. And what’s ESPN going to do? They don’t have the ability to link up anything that would be on an ad to buy today through digital and then, “Oh, by the way, you’d be able to chat about the game in real time in the quarter”. So the engagement, and we haven’t even talked about, like, where sports betting flows in and who gets pieces of that kind of engaging content too. So much more engaged platform with way more to sell and way more to gain and they push the envelope more than anyone putting CEOs in the space, right? It’s crazy. So, who knows?

Matt Roberts: Sure. Right.

Tai Brown: To circle back, before we wrap up a few more questions here, Matt. I mean, you guys talked about Texas and Oklahoma and what we’re seeing in the news, potential conference changes, thinking on a grander scale beyond just Texas and the home of Texas, Oklahoma, but how do those types of moves affect the data here that you guys have produced?

Matt Balvanz: Yeah, great, great question. And you’re right. When you kind of let it off, we haven’t really dug in too deep. But questions definitely start to circle around our heads here. I mean, a couple things to keep in mind is that, if the SEC were to add two more teams, then they’re splitting their revenue two more ways, right, automatically. And so, where the Big 12 today maybe benefits that people don’t realize is that they’re splitting their pie only between 10 members. And so, it’s easier for on a per member basis for them to show high revenue numbers.

But if Texas and Oklahoma go to the SEC, they need to incrementally increase their TV revenue by more than what they were getting from a smaller pie at the Big 12 to make that worth their while. So the math is, to me, isn’t so obvious that a switch strictly from a media rights standpoint benefits them more. I think it’s probably more of a stability thing and seeing the writing on the wall and wanting to maybe be in the most stable conference to worry about no future realignment…

Tai Brown: Right. I have a quick follow up here. And I’m sure Matt wants to dive in on this one. But, and you’ll correct me if I’m wrong. Some of your calculations were based on the times though, either conferences or schools went to a College Football Playoff. And so it seems like with an Oklahoma, if they potentially went to the SEC, I mean, that would be based on your numbers more value than a Texas going to the SEC or something like that, because Oklahoma has been the college football player, please correct me if I’m wrong on that, because my brain doesn’t operate like yours.

Matt Roberts: Tai, people are…

Tai Brown: Go on ahead.

Matt Roberts: A lot of Texas fans are going to take real exception of that comment, Tai.

Tai Brown: But number of times they’ve been to the College Football Playoff. No? I mean, is that…?

Matt Balvanz: No, no, just say if history is our guide, that’s what I’ve learned.

Tai Brown: Okay.

Matt Balvanz: If you say that first…

Tai Brown: History is our guide.

Matt Balvanz: …you can say anything.

Matt Roberts: Yeah.

Tai Brown: Hilarious.

Matt Balvanz: But no, I think that what you have to think about though, too, is that the competition in the SEC is going to be even tougher. So it’ll be Oklahoma has been there more often but not by playing it, not by playing the schedule that you’d have to play in the SEC to get there. They’ve been playing the Big 12 schedule. So it’s tricky.

It’s definitely interesting. And then we try to think through the dominoes that fall, if this were to happen, right? What happens to the Big 12, the rest of the Big 12? And what does the Big Ten do to respond to the SEC growing? The thing to keep in mind as these rumors start to swirl is that really these conferences and the membership has most to do with what new states that you can add into your footprint. And so, by adding, so I’m just looking at like the Big Ten map here, right? So if the Big 12 loses Texas and Oklahoma, the Big Ten maybe can get into Kansas, in West Virginia, look to be kind of states that kind of fill in some gaps. And so that kind of opens them up to getting the Big Ten network into millions of more households that they that have would have to pay that in-territory carriage fee, which is a big boost to revenue into the Big Ten network and then shared between everyone else.

And so, with Texas A&M already in the SEC, you’re not adding a new state by adding them from the Big 12 either. So a lot of interesting things to think about. And I know there’s different forces at work here and motivations, but those are the things that we kind of think of, new states added and how the footprint grows and who goes where and how does the Big Ten responds.

Tai Brown: All right, Matt Roberts, if you’ll wrap us up with one of your super inquisitive questions.

Matt Roberts: I do have one that’s very macro that I’ve been thinking about this whole conversation and, again, contextually for the marketplace, we find ourselves… last week President [Mark] Emmert comes out and says we need to think about the framework of our association and where decisions can be made and why and how we treat different sports and etc. We have NIL, that’s the Wild West and everybody is still trying to sort through. And then I come to these numbers, and as I noted earlier, they are massive, I mean, really significant. And this is not some pie in the sky. This is a leading data and analytics firm who’s taken how allocation has occurred previously against, if history is our guide, in terms of where teams make the playoff and programs make the playoffs from certain leagues. And this is real linear math here. And it’s just significant.

So I’m watching the one hour documentary on former ACC Commissioner John Swofford the other night on the ACC network. And he’s in an interview in maybe 1990, when he was still the AD, I think, at Carolina at the time, or definitely was. And they asked about the challenge of being an athletic director. And he’s saying 30 years ago, it’s running a big business in the context of higher ed setting, which we would still say today. And that brings me back to this idea as interesting or maybe far out there as it seems, as we’ve jumped the shark on amateurism to a degree, speaking of NIL and the monies involved here, why does the Power Fives, Notre Dame, why do they need the NCAA to create this type of value proposition to the marketplace?

Matt Balvanz: So just, generally speaking, what’s the NCAA’s role in any of this?

Matt Roberts: Yeah, I think so.

Matt Balvanz: Yeah. Yeah, I mean, you know, I think to your point, it all stemmed originally from amateurism. And then these people being students first and athletes second, and as monetization at the micro level grows, and these dollars become huge, yeah, I think I mean, my hypothesis, and we did a big piece on this, too. I’m not sure what journal it was in, but we looked at like, if there was this, if this whole system blew up and we really kind of treated college football like we do the NFL, there would be some major, major, major shakeups across the board, I mean, you talk about more geographic splintering, and as opposed from going coast to coast, like the Big Ten is trying to do. You think more regionally, regional powerhouses kind of working toward a system to play each other ultimately. And I think, if that’s where we’re headed, I just think that’s too complicated and too much movement for the NCAA to kind of oversee or even pretend to oversee and have any control of.

So, this could be the type of thing, the Texas-Oklahoma thing to kind of, you know, the straw to break the camel’s back where they kind of step aside, which they’ve already sort of said, with name image and likeness, right? That, hey, you know, they were gonna hire a vendor to sort of oversee it from their perspective. And then they said, “Well, we don’t really want to do that now”. And then they said, “Well, I think you guys can just choose what you want to do here. And we’ll step back.” And so yeah, I don’t think it’s crazy to envision football, football first, kind of autonomously moving away from the NCAA and not being tethered to it at all. Just becoming too big to be controlled by the NCAA, and then, maybe that starts to trickle from there to college basketball is obviously the next place in the NCAA tournament and how that is monetized and run and everything else. So, yeah, we are headed for a wild ride. And hopefully we can all keep up.

Matt Roberts: Yeah, as we always say, never a dull moment.

Matt Balvanz: Nope.

Tai Brown: It is interesting. Of course, the NCAA doesn’t have anything to do with College Football Playoff. But just in terms of the big picture, this is, it’s very interesting. Matt, this has been an excellent conversation. We really appreciate you joining us here on AthleticDirectorU podcast.

Matt Balvanz: Absolutely. Anytime. I just had a lot of fun. Thanks, guys.

Tai Brown: That was Matt Balvanz. He’s a Senior Vice President for Analytics and Innovation at Navigate. And of course, this is Tai Brown with Matt Roberts, from AthleticDirectorU. And keep in mind, the role of a leader is to create and maintain an environment that people want to be a part of. And as always, be better tomorrow than you are today.