Every athletic department feels pressure to increase revenue. For many of these departments, ticket sales represent an area with high capacity for revenue growth. While the best ways to quickly improve ticket revenues are to win a championship, build a new stadium, or recruit a Heisman candidate, these strategies are rarely feasible for most athletics departments. A sounder strategy is to hire a proactive, outbound ticket sales force to improve sales, and as a result, increase revenue.

Through our observations, we (my colleagues Jonathan Jensen of University of North Carolina and Chad McEvoy of Northern Illinois University) decided to test the financial impact of employing a proactive outbound sales team on department revenue streams. These included schools using inhouse teams, or ones outsourcing to vendors like The Aspire Group and IMG Learfield Ticket Solutions.

Because many football and basketball season ticket purchases at FBS institutions require an annual gift, we also hypothesized the utilization of a proactive, outbound ticket sales team might also impact annual giving levels. Thus, my colleagues and I developed a methodology to assess our research questions, then developed a model to examine the effectiveness of outbound ticket sales within the college space. Below, I share of some of our results.

The sample in our study included all FBS institutions over the course of 13 academic years. During each of these years, we gathered the following pieces of data for every institution: (a) whether the school utilized a proactive outbound sales force; (b) whether that sales team was managed internally or outsourced; (c) the number of salespeople employed, (d) total annual ticket revenue, and (e) total annual donations.

Ticket revenue and annual donations were captured from the USA Today College Athletics Financial Database. Sales team information was gathered over the course of six years through a variety of methods including department website searches, inquires to outsourcing vendors, and personal conversations or email exchanges with department staff members.

In order to conduct our analysis, we developed what is called a fixed-effects, within-subjects regression model. Such a model would allow us to determine whether a single variable (such as whether or not a department employed a sales staff) had a relationship with another variable (such as ticket revenue). The within-subjects part of the model means analyses were made between one year of data from a specific school and another year of data from that same school. In other words, we were not comparing Air Force to Alabama, but rather 2009-10 Air Force data to 2010-11 Air Force data. This is a critical distinction with our study as few research studies examining college athletics revenues utilize longitudinal data.

In addition, we did capture some additional “control” variables in our model to account for important year-to-year differences. For example, we included number of home football games in a given year and football winning percentage for each season to account for any revenue differences that might be attributable to those factors.

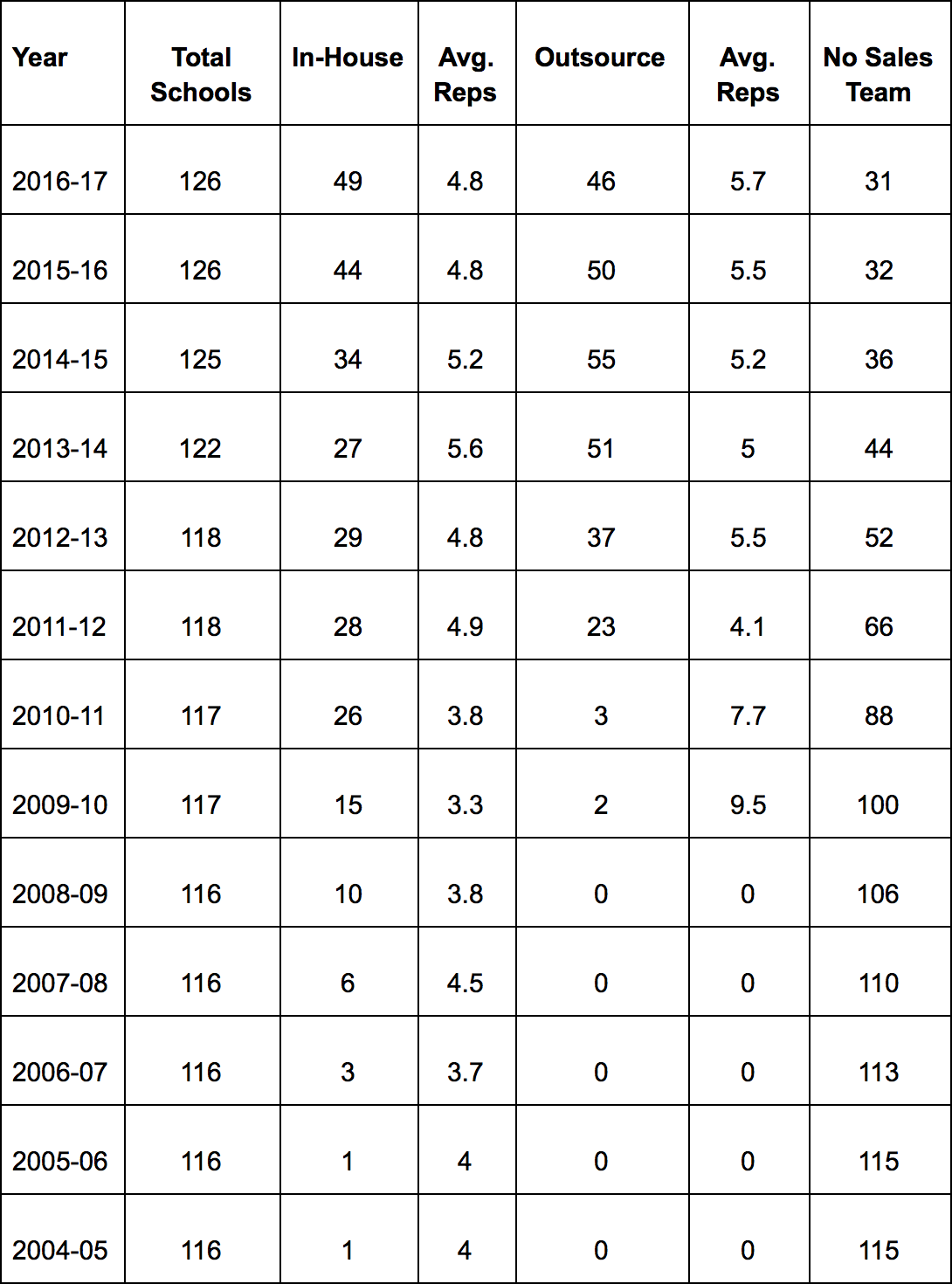

What did we discover? The first chart below (which includes all but three FBS institutions) depicts the number of schools employing a proactive outbound sales team, and whether that sales team is managed internally or outsourced, as well as the mean number of salespeople employed per school.

In the first year of data collection, only one athletics department among 116 schools utilized a proactive, outbound sales force (0.9%). By the 2016-17 school year, 95 out of 126 schools (75.4%) were utilizing some version of a proactive, outbound sales force.

Our regression models isolated the amount of variance in ticket revenue that could be attributed strictly to the decision to implement a proactive, outbound ticket sales team (we controlled for other factors which could impact ticket revenue, such as number of home football games, area population, and football winning percentage).

In the first year after starting such a sales force, that amount was $1,340,581. Two years after starting a sales team, the figure was $1,070,775 and three years after starting the team, the amount was $1,156,266. (For comparison sake, the isolated impact of an additional home football game on ticket revenue was about $1.1 million in our models.) These results suggest a clear and significant increase in ticket revenue can be expected after the addition of a proactive outbound sales team, both immediately and in the ensuing years.

In a second series of models, we examined the impact a proactive, outbound sales team might have on donations. The relationship between adding a proactive, outbound ticket sales force and annual contributions was also significant and positive. In the first year of implementing an outbound sales team, the amount of variance in donations that could be attributed strictly to the decision to implement a proactive, outbound ticket sales team was $1,523,902 in annual contributions. Two years after implementing a sales team, that figure was $1,447,076, and three years later, the amount was $2,480,476. Again, it appears the addition of a proactive, outbound ticket sales team clearly makes a significant difference in annual donations.

Based on our results, it appears FBS athletics departments not utilizing a proactive, outbound ticket sales team are missing an opportunity to generate significant revenue – in excess of $2 million to $3 million annually when ticket and donation revenue is combined.

Proactive, outbound sales efforts take many forms within college athletics. Some departments employ dozens of sales representatives, while others only utilize one or two sellers. In addition, some departments manage all ticket sales efforts internally, while others outsource this function to third-party vendors such as IMG Learfield Ticket Solutions and The Aspire Group. Finally, not all sales forces have access to the same resources and training. Yet despite these differences, it appears the effort to develop relationships with consumers and proactively solicit ticket sales from those prospective buyers, rather than rely strictly on marketing efforts and team performance, is relatively effective.

With total ticket revenue for FBS athletics departments ranging from $8 million to just over $14 million during the span of the study, an average bump of more than $1 million in annual ticket revenue is a considerable escalation, representing an average increase of nearly 10% of revenue for many of the athletics departments in the study.

Adding a robust sales force to any firm requires a significant financial commitment. Research has suggested to start a sales program at the University of Central Florida, it cost the athletics department $250,000 in expenses. Annual salaries and benefits for entry-level sellers will likely cost a department $40,000 to $65,000 per employee, while sales managers would demand even greater remuneration. In addition, athletics departments must expend resources to provide office space, computers, customer relationship management (CRM) software, and other equipment, plus provide human resource-related costs such as recruitment, hiring, and training. Still, even after incurring such costs, the addition of a proactive, outbound ticket sales force seems to provide a strong financial return on investment.

A final notable finding of the current study was the relationship of control variables on the outcome measures. Prior football season attendance and number of home football games in a season both had significant, positive relationships with ticket revenue. An explanation for these relationships is rational. Sport attendance for one season has been found to be a good predictor of attendance for the ensuing season, while home football schedules which include additional home football games would logically generate greater ticket revenue (in this study, over $1 million per additional game).

Perhaps the most intriguing finding among control variables, however, was a lack of significance in the relationship between current season football winning percentage and ticket revenue. Year-to-year changes in football success did not have a significant impact on year-to-year ticket revenue. This does not mean winning does not matter when it comes to gate revenue; historically successful football programs tend to generate more revenue than programs with less illustrious winning traditions.

However, on a macro scale, few football programs are able to make significant improvements in winning on a year-to-year basis (e.g. few teams go 3-9 one year, then 10-2 the next) improvement is generally more gradual, and thus large swings in ticket revenue based on team success tend to move more slowly as well.

Our findings suggest administrators would be wise to not rely strictly on football team performance to drive ticket revenue, but also to invest in building relationships with their fan base to produce results. The deployment of a dedicated sales force seems to be an effective way to achieve such results.

Our full paper can be found at this link.